I was out with godsister yesterday.

When I did a check-in with her, asking how she has been. She basically replied me that she has been busy, with her kid.

By the way, godsister is currently jobless.

Although I pressed on a sensitive spot by asking when is her intention to get a job and whether she’s doing anything in this particular area, but secretly, I admired her.

Why? For spending the time with and for her child everyday, going about without work (no income), and yet still able to focus on wanting the best for her child. We met up to stock up on some supplements, again, it was mainly for her child.

I know it’s some mothers’ dream to be able to just stay at home, to be able to play and educate their children, attend to them or simply put, the luxury of time to simply watch them grow.

How many of us can do this? And godsister is doing exactly just that.

But me, being me, knew that she can’t go on like this forever. Not when she has not built up a passive income stream that can sustain her lifestyle. (If you want to learn the basics of passive income, read my previous post here. If you are ready to take some action on building your passive income but need some help, feel free to email me.)

We sat down to have a drink at a coffeeshop. Then I wanted to get myself some food because I was hungry. So I took out $4, left my bag under godsister’s care and went to ‘hunt’ for food. Halfway through I came back, empty-handed and started digging into my bag. Godsister saw me and naturally was puzzled what had happened. I simply mentioned ‘money not enough’. Yes, that plate of rice had cost me $4.30.

Not long after, Godsister noticed another guy who went to order food and also didn’t have enough money on him and had to go to the nearest ATM to draw some money. I think both of us had underestimated how much we needed just to eat even at a place like coffeeshop that is not even air-conditioned.

This prompted me of an illustration that I have learnt a few months ago. One, that I think is appropriate to share here and to highlight the impact of:

1) Cost of retirement & how much do we really need

2) Rising food costs due to inflation

I love this illustration because it gave me a different perspective on what I had thought I knew, and also prompted me to rethink whether what I knew was really sufficient or not.

The illustration goes like this:

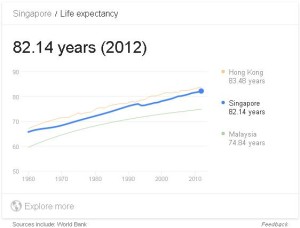

> The average expectancy of a person (in Singapore) is about 82 years old based on 2012 data.

> And the current retirement age (in Singapore) is 62.

In order words, each of us have about 20 years of living life (without work/active income).

Next, let’s look at how much a meal will cost us.

Based on my incident yesterday, I think it’s fair enough to say that a meal cost about $5 on average.

Therefore,

1 meal a day = $5 needed

3 meals a day = 3 meals x $5 = $15

3 meals a day for a year = $15 x 365 days = $5,475

3 meals a day for 20 years = $5,475 x 20 years = $109,500

In other words, at the point of us retiring or stopping work/active income, we’ll need about $109,500 in savings, just so that we can eat for the rest of the 20 years. And this amount is needed just for eating only!

And if you have read my previous blog post, you’d have learnt that food prices increase had ranged from 100% to 1000%, over the past 20 years. Taking the lowest increase of 100%, this means the $109,500 that I have at the point of retirement, technically speaking, will not last me fully for 20 years.

And the million dollar question now – Do you already have at least $109,500k ready for your next 20 years of food expenses?

If you have, congratulations. You can move on to the next stage of your retirement planning. Most finance articles suggest that one needs about $1m of retirement fund.

If you have not have $109,500k ready, depending on your life stage now, it’s still not too late to start planning and taking action.

Many of us are still doing what the mass market is doing. A recent Straits Times article reported that more are remaining in the workforce past 65, up from the 24% in 2009 to the 40% recently. Why? It’s not because they want to, it’s because they have to!

Do we really want to work because we have to when we are in our 60s?

If you would like to fast track your retirement goals so that you can give yourself the option of working when you want to and open to know a good tool on how you can achieve your first $109,500 retirement fund and continue on to build the next $109,500 retirement fund, feel free to email me at gwenkok@moremorecash.com